THEY RUN YOU…

THEY RUN YOU…

That would be the honest answer from most of us, myself included. Its the American way to spend more as we make more. I like to rationalize it thinking “it is all for the kids.” Nice try! Strong lessons on money, although not immediately appreciated, would be far more valuable than that Xbox, PS3, Iphone, huge house (only 50% used), etc, etc, etc. Consider this:

- 40% of working Americans are NOT saving for retirement.

- The average American household debt is $117,951

- $6500 of that debt is in credit cards

- 25% have no savings at all. Retirement or otherwise.

HOUSEHOLD BUDGET

Do you have one? Many households don’t and that is the root of the problem. I am embarrased to say that I dont have our 2011 plan put together yet. I have been spending too much time blogging. 🙂

When it comes to down to earth, in your face, no frills financial advice there is no one that even comes close to Dave Ramsey. If you dont already own it and want to get your finances in line you MUST obtain his book The Total Money Makeover. Its not rocket science and Dave tell’s it like it is. The basic premise he teaches is summed up in one of my favorite quotes from him:

Live today like no one else so you can live like no one else tomorrow.

OK, one more because it is so Dave Ramsey and so right on:

If you want something you’ve never had, you’ll have to do something you’ve never done.

Last one, I promise.

You wanna blow money? Put it in a ‘blow’ category in your budget. But at least admit it on paper!”

And that really sums up my point. Get it on paper and you will be amazed, shocked, and possibly even embarrassed when you see where your money is going. Then make a plan to CUT, GIVE, and SAVE. Dave Ramsey even provides some free simple forms and templates on his site to get you started. You can find them here.

The math isn’t difficult. If your expenses are larger than your income you have one of two choices:

- Increase your income

- Reduce your expenses

Take your pick and make something happen. Buying a lottery ticket is not one of the choices. At least not one that has any odds of making a difference other than increasing that expense line on your budget.

There is certainly some hypocrisy on my part here. I have consistently created budgets, used numerous different tools, and have had great success sticking to it and keeping it updated for ABOUT 30 DAYS. Its work that requires that you allocate the time to maintain it. In my Journey to Convergence, and one of the main goals for the Financial point of focus, I will not only create a budget but also maintain it and involve my children in the process. I am scared to death that our good fortune has actually resulted in them not having the slightest concept of how money works and that has to change.

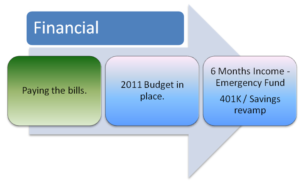

The goals for my Financial point of focus is depicted in the image to the left. I will keep the progress updated here. Next up – Family. Its a tough one. Its not one that is entirely in one individuals hands or is it?

How will you start running your finances vs. letting them run you?